The 5-Minute Rule for Medicare Graham

The 5-Minute Rule for Medicare Graham

Blog Article

The Only Guide to Medicare Graham

Table of ContentsAll About Medicare GrahamThe Buzz on Medicare Graham9 Easy Facts About Medicare Graham ExplainedThe smart Trick of Medicare Graham That Nobody is Talking AboutThings about Medicare GrahamThe Medicare Graham StatementsGetting My Medicare Graham To WorkThe Best Strategy To Use For Medicare Graham

In 2024, this limit was evaluated $5,030. When you and your strategy invest that amount on Part D medications, you have actually gone into the donut opening and will pay 25% for medications going ahead. As soon as your out-of-pocket costs get to the second limit of $8,000 in 2024, you are out of the donut hole, and "tragic protection" begins.In 2025, the donut opening will certainly be greatly gotten rid of for a $2,000 limit on out-of-pocket Part D medicine costs. When you strike that limit, you'll pay absolutely nothing else expense for the year. If you only have Medicare Components A and B, you could think about auxiliary personal insurance policy to assist cover your out-of-pocket costs such as copays, coinsurance, and deductibles.

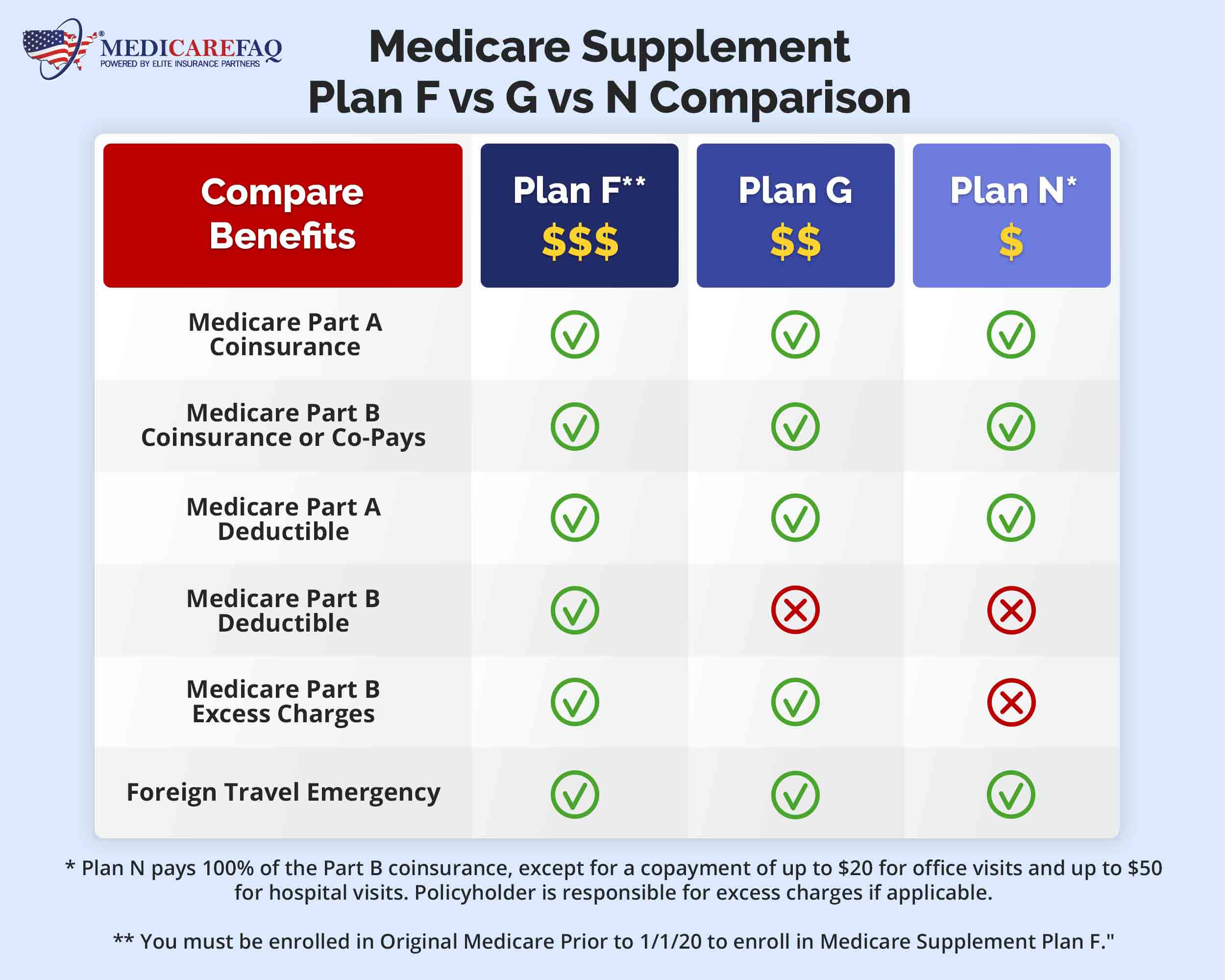

While Medicare Part C works as an alternative to your initial Medicare strategy, Medigap interacts with Components A and B and helps complete any type of protection voids. There are a few vital things to recognize about Medigap. You have to have Medicare Parts A and B prior to acquiring a Medigap plan, as it is a supplement to Medicare and not a stand-alone plan.

Medicare has actually developed throughout the years and currently has 4 parts. If you're age 65 or older and obtain Social Safety, you'll automatically be registered partly A, which covers a hospital stay expenses. Components B (outpatient solutions) and D (prescription medication benefits) are volunteer, though under certain situations you might be automatically enlisted in either or both of these too.

See This Report about Medicare Graham

, depending on how several years they or their partner have paid Medicare taxes. Personal insurance companies sell and administer these policies, however Medicare must accept any Medicare Advantage strategy prior to insurance firms can market it. Medicare does not.

typically cover Generally %of medical clinical, expenses most plans require strategies need to individual a fulfill before Medicare pays for medical services.

Medigap is a single-user plan, so partners have to buy their own coverage. The prices and benefits of various Medigap policies depend on the insurer. When it involves valuing Medigap strategies, insurance policy companies may make use of among a number of approaches: Premiums are the very same despite age. When a person begins the plan, the insurance service provider factors their age right into the costs.

The Ultimate Guide To Medicare Graham

The insurer bases the initial premium on the individual's existing age, but premiums increase as time passes. The rate of Medigap prepares differs by state. As kept in mind, rates are reduced when an individual purchases a plan as quickly as they get to the age of Medicare qualification. Specific insurer might likewise offer price cuts.

Those with a Medicare Advantage strategy are disqualified for Medigap insurance policy. The moment may come when a Medicare plan holder can no more make their very own decisions for reasons of psychological or physical wellness. Prior to that time, the individual ought to designate a relied on individual to serve as their power of lawyer.

The person with power of attorney can pay expenses, file taxes, collect Social Security advantages, and select or alter health care strategies on part of the guaranteed person.

4 Simple Techniques For Medicare Graham

Caregiving is a requiring task, and caregivers typically invest much of their time satisfying the needs of the person they are caring for.

army professionals or individuals on Medicaid, other choices are offered. Every state, as well as the District of Columbia, has programs that permit qualifying Medicaid receivers to handle their lasting treatment. Depending upon the individual state's regulations, this may consist of hiring about provide treatment. Given that each state's regulations vary, those seeking caregiving repayment have to explore their state's demands.

Some Known Details About Medicare Graham

The cost of Medigap plans varies by state. As noted, costs are lower when a person buys a policy as soon as they reach the age of Medicare qualification.

Those with a Medicare Benefit strategy are disqualified for Medigap insurance coverage. The time may come when a Medicare plan holder can no more make their very own choices for factors of psychological or physical health and wellness. Prior to that time, the person should mark a trusted person to function as their power of lawyer.

An Unbiased View of Medicare Graham

A power of attorney record permits an additional individual to carry out company blog here and choose on behalf of the guaranteed person. The person with power of attorney can pay expenses, documents tax obligations, accumulate Social Safety advantages, and select or transform health care plans on behalf of the guaranteed person. An option is to call a person as a healthcare proxy.

Caregiving is a demanding task, and caregivers typically invest much of their time satisfying the demands of the individual they are caring for.

Report this page